Tax on Individuals Doing Affiliate Marketing

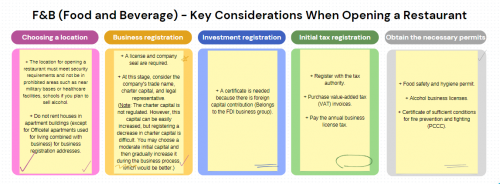

16/07/2024- Choosing a location:

- The location for opening a restaurant must meet security requirements and should not be in restricted areas such as near military facilities, medical institutions, or schools, especially if you plan to sell alcohol.

- Do not rent an apartment in a condominium (except for Officetel apartments) to use as a business address.

- Business registration:

- You need a business license and a company seal.

- At this stage, consider the company’s trade name, charter capital, and legal representative. (Note: Charter capital is not regulated. However, it can be easily increased but reducing it is difficult. You can choose a moderate initial capital and gradually increase it during the business process, which is better.)

- The registered business sectors on the license must include the following codes:

|

1 |

Restaurants and mobile food service activities |

5610 |

|

2 |

Other food service activities |

5629 |

|

03 |

Provision of food services under occasional contracts with customers |

5621 |

|

04 |

Beverage serving activities |

5630 |

- Investment Registration: This certification is required for foreign capital contributions (belonging to the FDI group).

- Initial Tax Registration: Register with the tax authority, purchase value-added tax (VAT) invoices, and pay the annual business license tax. The business license tax is based on the registered charter capital. For example, it is 2,000,000 VND if the charter capital is 10 billion VND or less.

- Open a bank account.

- Obtain Necessary Permits: Obtain necessary permits such as a food safety and hygiene permit, an alcohol business license, and fire prevention and fighting certification.