Notes on Procedures in Restaurant Business in Vietnam

16/07/2024

Reasons for the Discrepancy Between Tax Declaration and Data on the “hoadondientu.gdt.gov.vn” Page

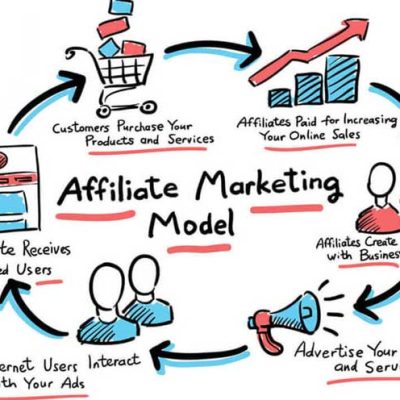

16/07/2024- What is Affiliate Marketing (AFF)?

- AFF is the activity of brokering online sales on social networks. Partners engaged in AFF will receive a commission from the selling business or e-commerce platform.

- Do individuals engaged in AFF have to pay taxes?

- According to the current tax policy (Circulars 111/2013, 219/2013, 40/2021), individuals engaged in AFF must pay:

+ Personal Income Tax (PIT) if not registered for business, or

+ PIT and Value Added Tax (VAT) if registered for business.

- What are the tax rates, and how is tax declared?

3.1 In case the individual is not registered for business

- If there is an employment contract with the business or e-commerce platform for 3 months or more: the organization paying the commission will apply PIT deduction according to the progressive tax schedule (rates from 5% – 35%), with personal relief of 11 million VND/month, and 4.4 million VND/month for each dependent.

- If the individual does not have an employment contract or has one for less than 3 months: when paying commission from 2 million VND/time or more, a 10% tax deduction must be applied to the income before payment to the individual.

3.2 In case of business registration and tax registration

- The individual will declare and pay a total tax of 7% on the received commission (including 5% VAT and 2% PIT).