Comparison between Enterprises and Household Businesses: Which Type Should You Choose?

16/09/2024

Establishing an FDI Enterprise in Vietnam

15/10/2024Based on Official Dispatch No. 83830/CTHN-TTHT regarding tax obligations for renting out property dated November 28, 2023:

“Individuals engaged in business activities with an annual revenue from production and business activities not exceeding 100 million VND are exempt from VAT and personal income tax (PIT) according to the tax laws on VAT and PIT. For individuals who only have rental income, if the annual rental revenue does not exceed 100 million VND, they are exempt from VAT and PIT as stipulated in Clause 3, Article 1 of Circular No. 100/2021/TT-BTC issued by the Ministry of Finance.

Individuals renting out property are responsible for accurately, honestly, and fully declaring taxes and submitting tax documents on time; they are liable before the law for the accuracy, honesty, and completeness of their tax documents as stipulated in Clause 2, Article 4 of Circular No. 40/2021/TT-BTC dated June 1, 2021, issued by the Ministry of Finance.”

In summary, if your rental income is under 100 million VND per year:

• You are exempt from VAT and PIT.

• Despite the tax exemption, you still need to declare your taxes.

• The tax declaration deadline is before January 30 of the following year. Failure to meet this deadline may result in penalties.

Detailed instructions on steps to declare rental tax

Situation Description:

A business rents a house from an individual. The individual earning income from property rental must declare and pay taxes on this rental income.

Current Situation:

• The individual is obligated to declare taxes for the property rental activity. If the contract stipulates that the tenant will declare taxes on behalf of the landlord, the business will declare taxes on behalf of the landlord.

Other notes according to Article 4 of Circular 92/2015/TT-BTC:

b) Tax rate on revenue:

• The value-added tax (VAT) rate for property rental activities is 5%.

• The personal income tax (PIT) rate for property rental activities is 5%.

c) Determining the amount of tax payable:

• VAT payable = Taxable revenue x VAT rate of 5%

• PIT payable = Taxable revenue x PIT rate of 5%

So:

• Taxable revenue for VAT and taxable revenue for PIT are guided in point a, clause 2 of this Article.

• The VAT rate and PIT rate are guided in point b, clause 2 of this Article.

d) Time of determining taxable revenue:

• The time of determining taxable revenue is the start of each payment period as specified in the property rental contract.

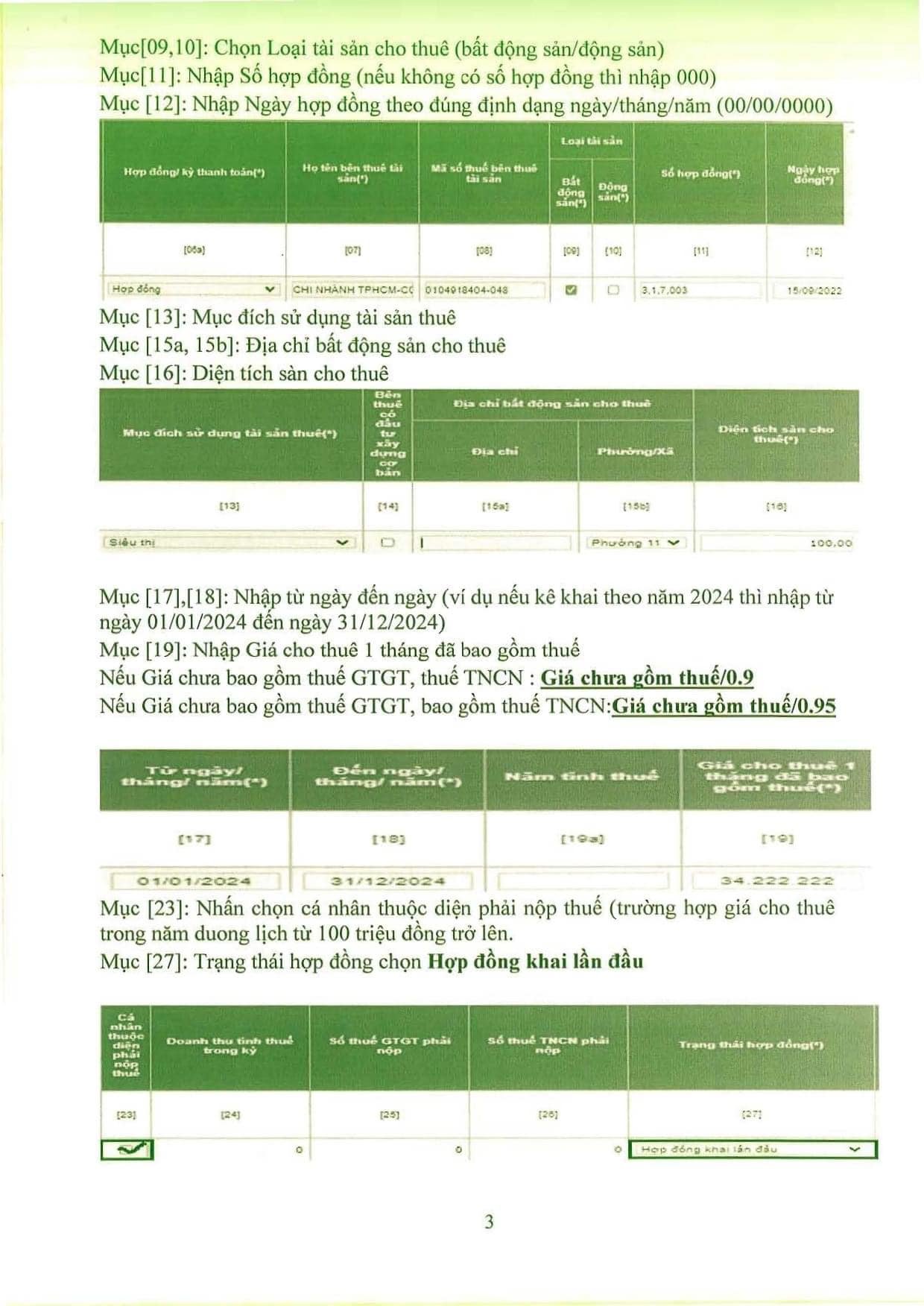

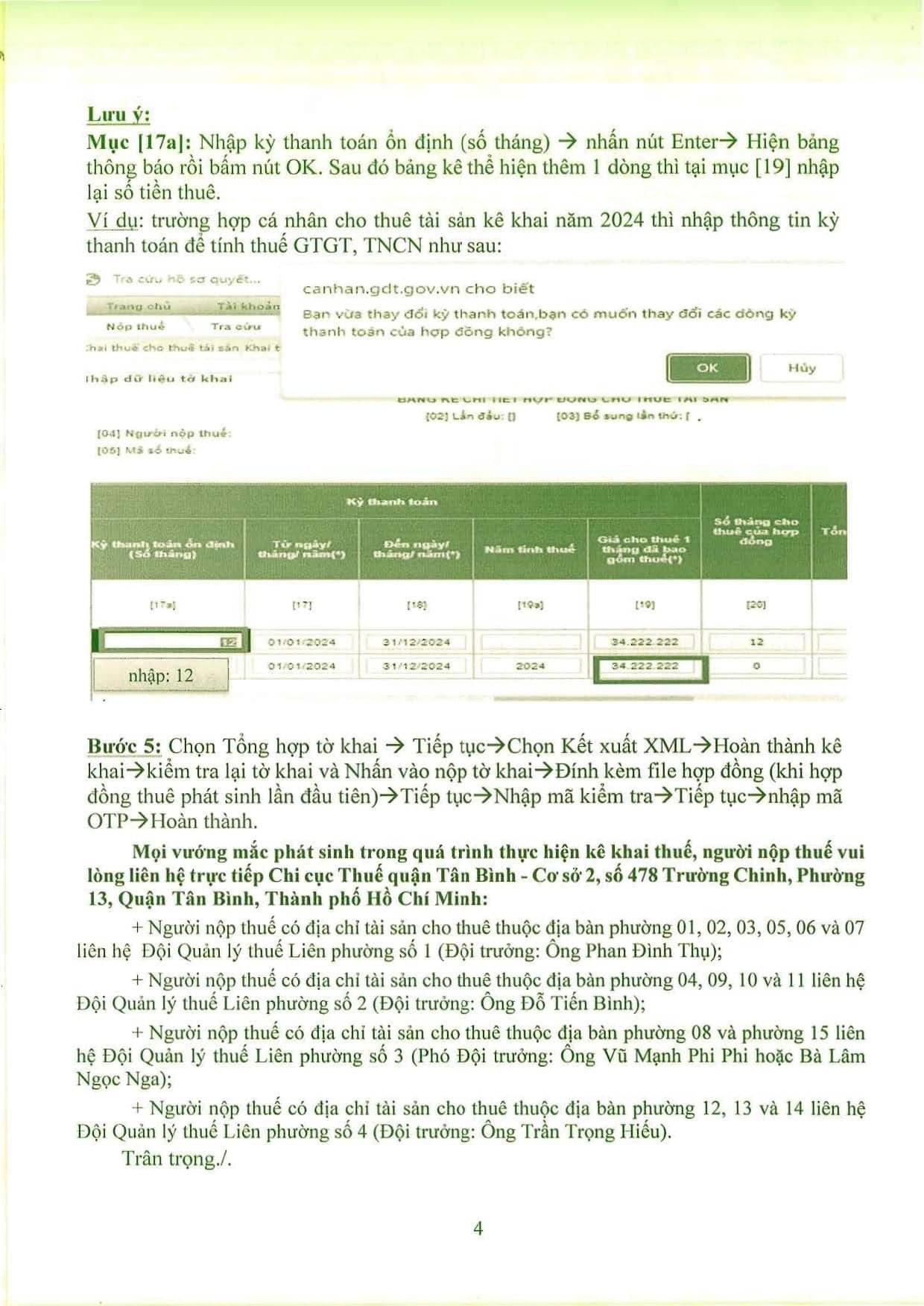

Steps for declaration:

Good luck everyone!