Reasons for the Discrepancy Between Tax Declaration and Data on the “hoadondientu.gdt.gov.vn” Page

16/07/2024

Guide to online unemployment benefits application

30/07/20241. Cases of electronic invoices with errors and principles of handling:

Based on Article 19 of Decree No. 123/2020/ND-CP; Article 7 and Clause 6 of Article 12 of Circular 78/2021/TT-BTC, the Tax Authority guides taxpayers on how to handle electronic invoices (E-invoices), and the summary data of E-invoices that have been sent to the tax authorities (TAX AUTHORITY) with errors as follows:

a) Electronic invoices:

|

Cases of Errors |

Principles of Error Handling |

Notes |

|

The seller discovers that the electronic invoice, which has been assigned a code by the tax authority, has not yet been sent to the buyer and contains errors. |

Step 1: The seller shall notify the tax authority using Form No. 04/SS-HĐĐT Appendix IA issued with Decree 123/2020/NĐ-CP regarding the cancellation of the E-invoice with a code that has been issued with errors. Step 2: Issue a new E-invoice, digitally sign it, and send it to the tax authority to obtain a new invoice code to replace the incorrectly issued invoice. Step 3: Resend the correct invoice to the buyer. |

The seller has the option to use Form No. 04/SS-HĐĐT to notify the adjustment for each invoice with errors or to notify the adjustment for multiple E-invoices with errors and send it to the tax authority at any time, but no later than the last day of the tax declaration period for value-added tax in which the adjusted E-invoice arises. |

| Electronic invoices with the tax authority code or electronic invoices without the tax authority code that have been sent to the buyer, where the buyer or seller discovers errors in the name, address of the buyer but not in the Tax Authorityx identification number (TIN), other contents are correct. |

Step 1: The seller informs the buyer about the invoice errors and that there is no need to reissue the invoice. Step 2: The seller notifies the tax authority about the E-invoice errors using Form No. 04/SS-HĐĐT (except for the case where the E-invoice without the tax authority code with the aforementioned errors has not yet sent the invoice daTax Authority to the tax authority). |

• The seller does not have to reissue the invoice;

• In the case where the E-invoice has been issued with errors and the seller has processed it by adjusting or replacing according to the regulations at point b, clause 2, Article 19 of Decree No. 123/2020/NĐ-CP, and then discovers that the invoice continues to have errors, the subsequent processing by the seller will be carried out in the manner applied when handling the first error;

• The seller has the option to use Form No. 04/SS-HĐĐT to notify the adjustment for each invoice with errors or to notify the adjustment for multiple E-invoices with errors and send it to the tax authority at any time, but no later than the last day of the Tax Authorityx declaration period for value-added Tax Authorityx in which the adjusted E-invoice arises. |

| Electronic invoices that have been assigned the tax authority code or electronic invoices without the tax authority code that have been sent to the buyer, where the buyer or seller discovers errors in the Tax Authorityx identification number (TIN); errors in the amount sTax Authorityted on the invoice, incorrect Tax Authorityx rate, Tax Authorityx amount, or the goods listed on the invoice do not meet the specifications, quality. |

Method 1: Step 1: The seller issues an E-invoice adjustment for the invoice that was issued with errors. If the seller and buyer have agreed to draft a written agreement specifying the errors before issuing the adjustment invoice for the invoice with errors, then the seller and buyer shall draft a written agreement deTax Authorityiling the errors, after which the seller issues an E-invoice adjustment for the invoice with errors. The E-invoice adjustment for the invoice with errors must include the phrase “Adjustment for invoice Form No… symbol… number… date… month… year”. The seller digiTax Authoritylly signs the new E-invoice adjustment for the invoice with errors (for the case of using E-invoices without a TAX AUTHORITY code) or sends it to the TAX AUTHORITY for the TAX AUTHORITY to issue a code for the E-invoice (for the case of using E-invoices with the tax authority code). Step 2: Resend the correct invoice to the buyer.

Method 2: Step 1: The seller issues a new E-invoice to replace the E-invoice with errors unless the seller and buyer have agreed to draft a written agreement specifying the errors before issuing a replacement invoice for the invoice with errors, in which case the seller and buyer shall draft a written agreement deTax Authorityiling the errors, after which the seller issues a new E-invoice to replace the invoice with errors. The new E-invoice replacing the invoice with errors must include the phrase “Replacement for invoice Form No… symbol… number… date… month… year”. The seller digiTax Authoritylly signs the new E-invoice replacement for the invoice with errors (for the case of using E-invoices without a TAX AUTHORITY code) or sends it to the TAX AUTHORITY for the TAX AUTHORITY to issue a code for the E-invoice (for the case of using E-invoices with the tax authority code). Step 2: Resend the correct invoice to the buyer. |

Tax Authorityxpayers do not have to use Form No. 04/SS-HĐĐT to notify the TAX AUTHORITY;

In the case where the E-invoice has been issued with errors and the seller has processed it by adjusting or replacing according to the regulations at point b, clause 2, Article 19 of Decree No. 123/2020/NĐ-CP, and then discovers that the invoice continues to have errors, the subsequent processing by the seller will be carried out in the manner applied when handling the first error;

In the case where the regulations stipulate that the E-invoice is issued with errors in the invoice form symbol, invoice symbol, or invoice number, the seller shall only make adjustments and not perform cancellation or replacement; Specifically, for content regarding the value on the invoice with errors: adjust upwards (indicate with a plus sign), adjust downwards (indicate with a minus sign) according to the actual adjustment. |

| The tax authority discovers that the electronic invoice, whether it has the tax authority code or not, has been issued with errors. | • The tax authority notifies the seller according to Form No. 01/TB-RSĐT Appendix IB issued with Decree 123/2020/NĐ/CP for the seller to check for errors.

• Within the notification period sTax Authorityted on Form No. 01/TB-RSĐT, the seller shall notify the tax authority using Form No. 04/SS-HĐĐT about the inspection of the E-invoice that was issued with errors, clearly sTax Authorityting the basis for the inspection is the notification Form No. 01/TB-RSĐT of the tax authority (including the notification number and date). • If the seller does not notify the tax authority by the deadline sTax Authorityted on Form No. 01/TB-RSĐT, the tax authority will issue a second notification to the seller according to Form No. 01/TB-RSĐT. If the seller does not notify after the second notification period sTax Authorityted on Form No. 01/TB-RSĐT, the tax authority will consider moving to the case of inspection regarding the use of E-invoices. |

|

| Electronic invoices issued in accordance with the regulations of Decree No. 51/2010/ND-CP dated May 14, 2010, Decree No. 04/2014/ND-CP dated January 17, 2014, by the Government and guiding documents from the Ministry of Finance that conTax Authorityin errors. |

Step 1: The seller and buyer must draft a written agreement deTax Authorityiling the errors; Step 2: The seller shall notify the tax authority using Form No. 04/SS-HĐĐT Step 3: The seller issues a new E-invoice (with or without the tax authority code) to replace the invoice that was issued with errors. The replacement E-invoice for the invoice with errors must include the phrase “Replacement for invoice Form No… symbol… number… date… month… year”. The seller digiTax Authoritylly signs the new replacement E-invoice for the invoice with errors (for the case of using E-invoices without a code) or the seller sends it to the tax authority to be issued a code for the replacement E-invoice (for the case of using E-invoices with the tax authority code). Step 4: Send the correct invoice to the buyer. |

b) Summary daTax Authority Tax Authorityble of electronic invoices

- After the deadline for transferring the summary daTax Authority Tax Authorityble of E-invoices to the tax authority (TAX AUTHORITY), if there is missing E-invoice daTax Authority in the summary daTax Authority Tax Authorityble that was sent to the TAX AUTHORITY, the seller must send a supplemenTax Authorityry summary daTax Authority Tax Authorityble of E-invoices;

- If the summary daTax Authority Tax Authorityble of E-invoices sent to the TAX AUTHORITY conTax Authorityins errors, the seller must send corrected information for the daTax Authority declared on the summary Tax Authorityble;

- The adjustment of invoices on the summary daTax Authority Tax Authorityble of E-invoices as stipulated in point a.1, clause 3, Article 22 of Decree No. 123/2020/NĐ-CP must include complete information: invoice form symbol, invoice symbol, invoice number in column 14 “related invoice information” of Form 01/TH-HĐĐT issued with Decree No. 123/2020/NĐ-CP (except in cases where the E-invoice does not necessarily have to include complete information of invoice form symbol, invoice symbol, invoice number as regulated in clause 14, Article 10 of Decree No. 123/2020/NĐ-CP).

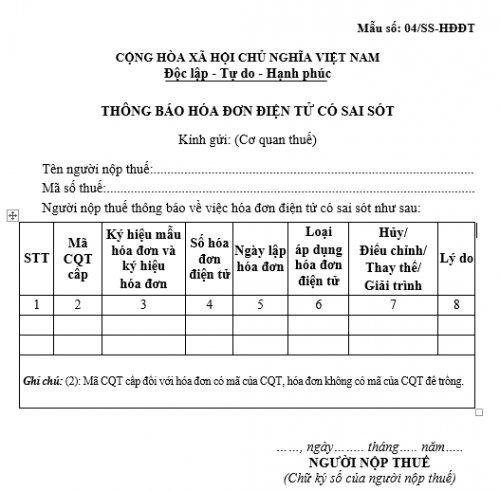

2. Form No. 04/SS-HĐĐT Appendix IA issued with Decree 123/2020/NĐ-CP

Form No. 04/SS-HĐĐT is used to notify the tax authority about electronic invoices with errors.