Tax on Individuals Doing Affiliate Marketing

16/07/2024

Latest Handling of Electronic Invoices with Errors

16/07/2024Common situations leading to discrepancies in the value of Goods and Services, input VAT for the tax period:

-

Declared figures are lower than the invoice data:

- There are input invoices with low value, the company does not declare input tax deduction and has accounted for all as expenses (e.g., bank fees).

- There are input invoices, but the company incorrectly declares the tax deduction for the wrong tax period. The company must re-declare for the correct tax period (i.e., make an additional declaration so that the declaration period matches the date on the invoice).

- There are input invoices, but the company has omitted them from accounting and has not declared input VAT as required. The company must account for and declare taxes according to regulations.

- The purchasing company did not buy goods or services, but the selling company issued an invoice to the buyer. The business sends an official letter to the tax authorities to handle the false invoicing.

- The company made a declaration error, declared incorrect figures… The company must review and re-declare according to the correct data.

- ……………….

-

Declared figures are higher than the invoice data

- There are input invoices, but the company declares the tax deduction for the wrong tax period. The company must re-declare for the correct tax period (i.e., make an additional declaration so that the declaration period matches the date on the invoice).

- There are some input invoices that have not been updated in the electronic invoice system.

- The company made a declaration error, declared incorrect figures… The company must review and re-declare according to the correct data.

- …

-

If the company’s review shows no actual discrepancy as notified:

The company did not declare incorrectly, it is a system data update error, the system data is not accurate. Based on the specific situation of the company to make an explanatory official letter.

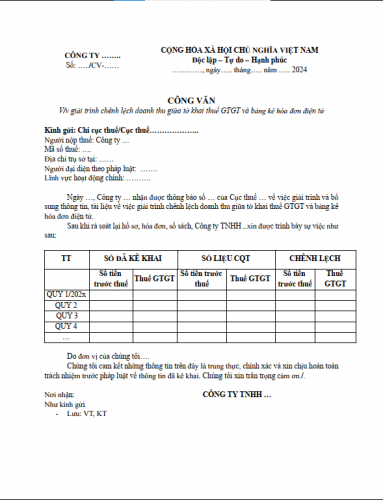

The template document is attached here.